Dfp How to Select Which Yield Groups Are Used

They keep you up to date on what percentage of ad impressions are going to each type of line item. G-spread Y c Y g.

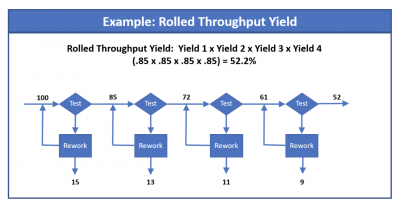

Rolled Throughput Yield Rty Definition

To help you navigate these changes and learn more.

/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

. DFPs dividend yield history payout ratio proprietary DARS rating much more. A 91-day commercial paper is quoted at a discount rate of 55 for a year assumed to have 360 days. Click Delivery Yield groups 3.

Closed end funds are subject to the risk of their underlying assets and investment strategy. DFP stock quote history news and other vital information to help you with your stock trading and investing. G-spread nominal spread is the difference between the yield on Treasury Bonds and the yield on corporate bonds of the same maturity.

Find and evaluate your experiments When you run an experiment your experiment appears in. Stay up to date on the latest stock price chart news analysis fundamentals. Flaherty Crumrine Dynamic Preferred and Income Fund Inc.

Select the Ad format and Inventory type you wish. Click Create Yield Group 4. Unlike open end funds closed end funds trade on an exchange at a.

Impression traffic allocated to an experiment group to a control group without the rule changes. DoubleClick for Publishers and the former brand names. People got used to DFP ie.

The dividend yield ratio for Company A is 27. The 1 Source For Dividend Investing. Click Delivery Yield groups.

There are visual representations of the distribution of ad impressions over the time period chosen. You can also begin typing to filter the list. Click Select ad network and select the name of your yield partner.

Reports Queries Historical Yield. In the past DFP has relied on manual inputs and tribal knowledge of DFP members or TI test community to select an appropriate probe card technology and vendor. Enter a unique yield group Name thats descriptive for reporting.

Annual payout 4 year average yield yield chart and 10 year yield history. Unfortunately the DFP yield reports are a neglected feature of DFP. Dividend Yield Ratio 030 030 030 030 45 002666 27.

At the top left of the DFP Reports menu there is a Yield Report. If you cannot find your ad network in the list choose Other company. Click New yield group.

Including information about important dividend dates. A distribution yield is the measurement of cash flow paid by an exchange-traded fund ETF real estate investment trust or another type of income-paying vehicle. Calculating the Bond Equivalent Yield.

It is calculated by dividing the current stock price by the sum of the. Enter a unique Yield group name 5. Line item type and priority are a starting point to determine how a line item competes with other line items yield groups and Ad Exchange for impressions.

Y c yield. DFP sales management must be enabled in your network to see this report type. The Funds investment objective is to seek total return with an emphasis on high current income.

When considering the Flaherty Crumrine Dynamic Preferred Income Fund Inc stock. After all theyve been around for almost 20 years. A high-level overview of Flaherty Crumrine Dynamic Preferred and Income Fund Inc.

Ad format and inventory sizes. Line item type and priority are only. Find the latest Flaherty Crumrine Dynamic Preferred and Income Fund Inc.

GAAP PE is a relative valuation measure used to determine if a stock is expensive in relation to its peers. Select the Ad format Interstitial and Environment Mobile app for app inventory and web. Find the latest dividend history for Flaherty Crumrine Dynamic Preferred and Income Fund Inc.

The dividend yield ratio for Company A is calculated as follows. Here you can select multiple yield groups or you can also check the performance of individual partners by following the below steps.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Duration And Convexity To Measure Bond Risk

Common 6 Sigma Tools Now If We Can Just Get The Cmms Software Industry To Apply 6 Sigma To Their Cmms Design Proce Lean Six Sigma Lean Sigma Change Management

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

No comments for "Dfp How to Select Which Yield Groups Are Used"

Post a Comment